#Car insurance

Explore tagged Tumblr posts

Text

467 notes

·

View notes

Text

Kenn Dahl says he has always been a careful driver. The owner of a software company near Seattle, he drives a leased Chevrolet Bolt. He’s never been responsible for an accident.

So Mr. Dahl, 65, was surprised in 2022 when the cost of his car insurance jumped by 21 percent. Quotes from other insurance companies were also high. One insurance agent told him his LexisNexis report was a factor.

LexisNexis is a New York-based global data broker with a “Risk Solutions” division that caters to the auto insurance industry and has traditionally kept tabs on car accidents and tickets. Upon Mr. Dahl’s request, LexisNexis sent him a 258-page “consumer disclosure report,” which it must provide per the Fair Credit Reporting Act.

What it contained stunned him: more than 130 pages detailing each time he or his wife had driven the Bolt over the previous six months. It included the dates of 640 trips, their start and end times, the distance driven and an accounting of any speeding, hard braking or sharp accelerations. The only thing it didn’t have is where they had driven the car.

On a Thursday morning in June for example, the car had been driven 7.33 miles in 18 minutes; there had been two rapid accelerations and two incidents of hard braking.

According to the report, the trip details had been provided by General Motors — the manufacturer of the Chevy Bolt.

Eight insurance companies had requested information about Mr. Dahl from LexisNexis over the previous month.

(continue reading)

74 notes

·

View notes

Text

Is big brother riding shotgun in your car? 🤔

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think about it#think for yourselves#think for yourself#do your homework#do some research#do your own research#ask yourself questions#question everything#car insurance#spies#spying#cars#vehicles#you decide

237 notes

·

View notes

Text

despite all the people in Gotham who keep losing their cars for various reasons (read: Batman and co.), they don't really complain - not when Brucie Wayne conveniently pays for the Car insurance, saying "it's because the destroyed cars are surrounding my property, it gives a terrible look"

(you could think The Batman does this on purpose too; the cars who usually get absolutely destroyed are usually already broken, and then to have Mr.Wayne pay for it for practically no reason)

101 notes

·

View notes

Text

I'm guessing it doesn't stand for Cultural Inclusivity Training.

Saturday Evening Post - November 17th 1956

#1956#insurance#car insurance#native american#vintage ads#vintage ad#advertising#advertisement#1950s#1950s ad#1950's#1950's ad#funny#humor#humour

13 notes

·

View notes

Note

Which would be better to do: pay my car insurance in one lump sum reducing my emergency savings to almost nothing or put my car insurance on monthly payments which would slightly increase the amount I pay but allow me to keep my emergency savings intact. I know this is probably a personal preference question but was hoping the almighty bitches might have some input to help me make a decision.

Option #2.

I'd only pre-pay auto insurance if your emergency savings fund would NOT be depleted by it. This is what I do to save a little money every year, but my emergency fund is nice and fat and I can easily replace it within a few months when I use it.

Here's why: You will need your emergency fund to pay for your insurance deductible in the event of an insurance claim. If you've spent it all on your monthly insurance payment, then you will have nothing left for your deductible.

And if that didn't make sense, we explain all about it in these posts:

Dafuq Is Insurance and Why Do You Even Need It?

You Must Be This Big to Be an Emergency Fund

3 Times I Was Damn Grateful for My Emergency Fund (And Side Income)

Did we just help you out? Tip us!

#insurance#car insurance#insurance premium#insurance deductible#how insurance works#finance#personal finance#advice#money tips

49 notes

·

View notes

Text

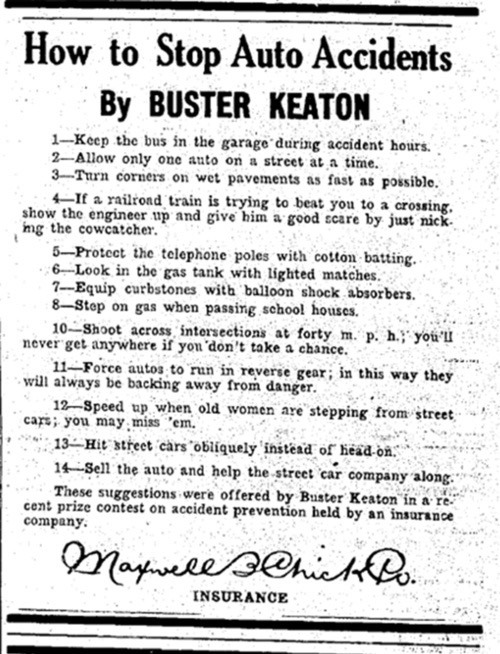

Good Job Buster! 👍

#buster keaton#comedy#insurance#car insurance#accident prevention#silent movies#1920s#silent film#silent comedy#1920s cinema#golden age of hollywood#hollywood#slapstick

34 notes

·

View notes

Text

The provincial government has vowed to take steps to close a troubling loophole that allows prohibited drivers to buy vehicle insurance in their name through ICBC, following Global News reporting. Roy Heide was a prohibited driver with no licence before he earned the dubious distinction of holding what the Abbotsford Police Department believes is the worst impaired driving rap sheet in Canadian history. Yet ahead of the August 2022 crash that secured his 21st impaired driving conviction last month, Abbotsford police said Heide was able to insure his motorcycle with B.C.’s public auto insurer as the registered owner.

Continue Reading

Tagging @politicsofcanada

32 notes

·

View notes

Text

#tiktok#scammed#stolen vehicle#scam alert#scam#scammers#carmax#late stage capitalism#capitalism is the worst#capitalism is evil#capitalism kills#capitalism#psa#state farm#insurance#car insurance

18 notes

·

View notes

Text

I don't think people realize that with universal Healthcare, car insurance costs would go to to 1/3rd or 1/4 of what they are today.

Car insurance in the US for a 2022 Subaru (for example) is $150 a month or about $1750 a year for normal insurance. In Germany insuring the same car would cost $327 a YEAR.

If you want to get the best, complete coverage insurance, it would cost $981. Universal Healthcare would save money on our insurance premiums, medicine, hospitals, and also our god damn cars.

20 notes

·

View notes

Text

I would love to not be broke as fuck….like I have a FULL TIME JOB!!! A hard job. A job that requires (ignoring desantis on this one) a bachelors degree. A job that requires you to continually recertify and educate yourself. One where you’re consistently evaluated. Yet I still have to live with my sister and can barely make ends meet because of ridiculous rent prices. I just WANT TO BE FINANCIALLY FREE!!!!!!!!!

#between health insurance#ortho appointments (which hopefully is temporary and tbh my mom is#paying for it 😭#car insurance#car payment#rent#student loans federal and private#groceries#it’s just TOO MUCH!!!!!!!!

10 notes

·

View notes

Text

Automakers are collecting driving data from customers and quietly providing it to insurance companies, and the practice has resulted in some unassuming drivers seeing their coverage increased or even terminated due to the practice, a new report reveals.

The New York Times reported this week that car manufacturers like General Motors and Ford are tracking drivers’ behavior through internet-connected vehicles, and sharing it with data brokers such as LexisNexis and Verisk, which create “consumer disclosure reports” on individuals that insurance companies can access.

The consumer reports do not show where a driver has traveled, but they do provide information on length of trips and driving behavior, such as “hard braking,” “hard accelerating” and speeding. Insurance companies can use those reports to assess the risk of a current or potential customer, and adjust rates or refuse coverage based on the findings.

The Times highlighted the case of Kenn Dahl, the driver of a leased Chevrolet Bolt, who learned he and his wife's driving habits were being tracked when an insurance agent told him in 2022 that his LexisNexis report was a factor behind his insurance premium jumping 21%.

“It felt like a betrayal,” Dahl told the newspaper. “They’re taking information that I didn’t realize was going to be shared and screwing with our insurance.”

(continue reading) related ←

#politics#lexisnexis#data mining#smart cars#car insurance#privacy rights#kenn dahl#spyware#capitalism#privacy#consumer disclosure reports

120 notes

·

View notes

Text

We got our recent car insurance bill and it had increased by about 32%, which is crazy. Neither of us have been in any accidents or placed any claims, and our cars get older every year, so I would expect our premiums to stay the same or even decrease, and not to increase faster than inflation.

I called my insurance agent and explained, and she immediately said, this doesn't look right. Rates have increased a lot, but not by that much. She said the rate increase was only 11%.

We had moved over the past year, and it turned out that the insurance company added an "out of state license" surcharge because we updated our address but not our driver's license numbers. But we got new licenses and have in-state licenses. This took off 19%. Then I noticed there was a 2% surcharge for paying with a credit card, and we could remove that by paying from a checking account. With these two fixes this brought the increase to 11%.

I then realized, from talking to the agent, that we were paying for some coverage we didn't want. We took that off, and then the premium was reduced to slightly cheaper than what it had been, so we ended up with about a 7% decrease in our premium. So the net change was saving about 39% of the bill we received which is insane. All because I called.

By far the biggest decrease here was the 19% increase from the erroneous license records.

The moral of the story, if you ever see an unexpected increase in your bill for anything, and it seems disproportionate or doesn't make sense, call and ask. A lot of companies will just slap on a lot of fees by default, if they can get away with it, and the burden is on you to get them removed.

Even if you don't have any increase, if you are financially strained, and you have a particular big bill payment, call. There might be ways for you to save on the payment.

For example last year we called in and wanted to reduce the premium and it turned out there was a free driver safety course and my wife and I both took it, and that also slightly reduced our premiums.

10 notes

·

View notes

Text

Don't you just love dealing with insurance as a disabled person?

in august, someone driving a company vehicle hit my car and wrote it off. This car was modified to allow me to drive it, it had old mechanical hand controls that were nothing special but they got the job done. I can't drive without hand controls, physically or legally.

They f*cked us around with the claims process for so long that we decided we needed to go and try to get a car, paying out of pocket (putting ourselves in dept to do so) because public transport where we live is shit and I need to be able to go to appointments, not to mention my partner is a door dasher who depends on a car for our income.

In early November the insurance of the company the at-fault driver belonged to finally answered us back (but only after my partner and I AND the towing company who took the car threatened legal action because they were ghosting everyone) and they finally admitted they were at fault and asked for our terms. We only asked for the hand controls to be covered and that they pay the towing company and other costs associated with the accident (I think there were fees from council or something because oil spilled on the road but I don't remember details).

Much to my suprise, they agreed to pay for all of it, explicitly stating, in writing, that they'd pay for the cost of the hand controls and their installation in the new car. We gave them a quote from the only place "in our area" (aka 2 hours away) that could do the installation. The style I had no longer exists, and the next cheapest option is $8,800.

They answered us back today and offered us $3,000 total. That won't even cover the cost of the assessment the NSW government insists that I have to get done before they can be installed. Hell I don't even think that would cover the cost to get the old mechanical ones installed if they still existed, I paid $5,000 for them back in 2018/2019 and prices for all disability-related stuff has sky-rocketed since then. So despite them admitting their client was at fault, they still think it's fair that I should be out over $5,000 just to be able to use the car that replaced the one thier client wrecked. That's not even touching on how much we were out for the cost of the new car itself. We didn't ask for that, we just wanted the hand controls covered.

As if I don't have enough going on right now, I not get to add "fight with insurance" to the list.

[ID:A Gif showing a woman with black hair, a white shirt and blue skirt angrily flip over a small plastic table/End ID]

#I promise I'll stop with the rant posts soon but god I'm so tired 😭#Disabled Tax#disability#disabled#insurance#car insurance

24 notes

·

View notes

Text

Insurance is fucking wild.

I switched to a new insurance provider last month. They’re like “You’re covered from this day”

And I’m like “Amazing, so if I get into an accident between now whenever I can put a claim in?”

And the guys like “Yeah absolutely. You’re covered. Well get you a hire car, tow truck etc”

So anyway, about 3 weeks later I hit a kangaroo. Entire left front panel is fucked, my cars pouring out transmission fluid, steering fluid, oil; it starts but I can’t move it cause the axel is bent etc.

So it’s towed home and I call my insurance and lodge a claim.

They get me a hire car after me pushing- the hire car guys like “They don’t even fill out the paperwork work properly. You’ll have to give me a claim number and your card details”

The tow guys like “They didn’t fill out our paper work only gave us a claim number and that was it”

So anyway now it’s under fraud investigation cause I claimed too soon.

Like how the fuck do I prove I hit a kangaroo? I mean there’s hair still in the smashed part, the oil has been pooling in my driveway for a week now.

So yes I have insurance, yes I can claim- but I’ll be investigated for claiming.

This is what I pay almost 2k a year for 🥴

To add insult to injury; the kangaroo was fine the asshole.

#Insurance#Shelly Rants#Car Insurance#Kangaroo#I’m so anxious#WHAT IF THEY FIND IVE COMMITED FRAUD#EVEN IF I HAVENT#My payout won’t even cover a new car#AM I GOING TO JAIL

9 notes

·

View notes